Expert Iacopo Bertelli deep-dived into the topic of counterintuitive flows: when electricity is traded from a bidding zone with a high clearing price towards a bidding zone with a lower price. After a first analysis, Iacopo sheds his light on this phenomenon in this second article of a series.

Counterintuitive Flows in 2023 – Part 2 of 3 Last week I started a series of three articles focused on understanding and analysing counterintuitive flows in the European day-ahead electricity market. In part 1 I explained what counterintuitive flows are, and why they occur. Note: Yves Langer correctly pointed out that counterintuitive flows can also be caused by ramping constraints on HVDC interconnectors allocated in SDAC. I will show this in part 3. Today I will compare intuitive commercial exchanges with counterintuitive ones. All data (day-ahead prices and scheduled commercial flows) were retrieved from the ENTSO-E transparency platform

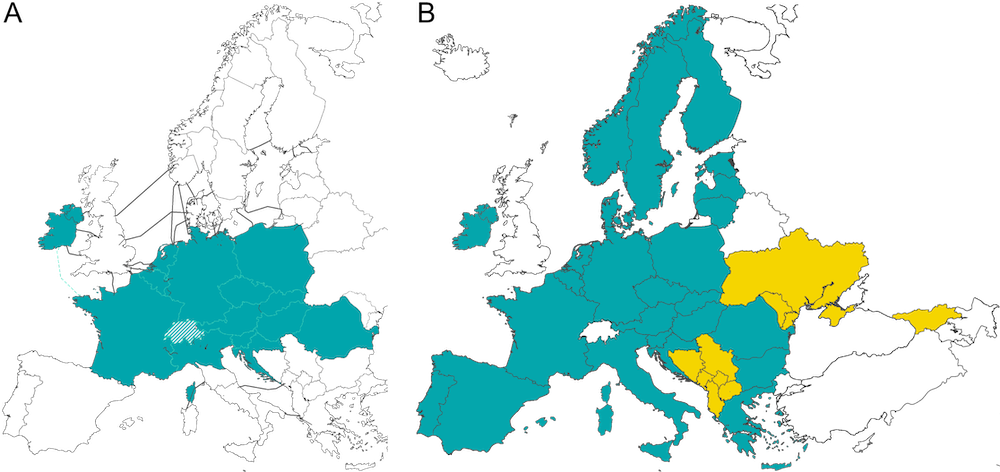

Before going into explanations, let's visualise what all the abbreviations for capacity calculation regions (CCRs) and bidding zones (BZs) in this article mean.

Capacity Calculation Regions as of January 2024. Right: Bidding Zones as of January 2024. Note that SEM is expected to join the Core CCR following a decision from ACER expected for March 2024 (however, the Celtic Interconnector will not be operational until 2026/27). GB, CH, RS are not part of SDAC but are mentioned in this article.

Market coupling at its best

Before delving into counterintuitive flows, let’s look at when things are 'ideal', i.e. when lines are not congested and full price convergence is achieved. Coordinated capacity calculation and market coupling (SDAC) ensure wholesale prices converge across all bidding zones. Note: never having congestions is not the aim, as it would require a large amount of transmission capacity – costly to build (and maintain) – to go unused most of the time, to ensure that hours of peak demand are not congested.

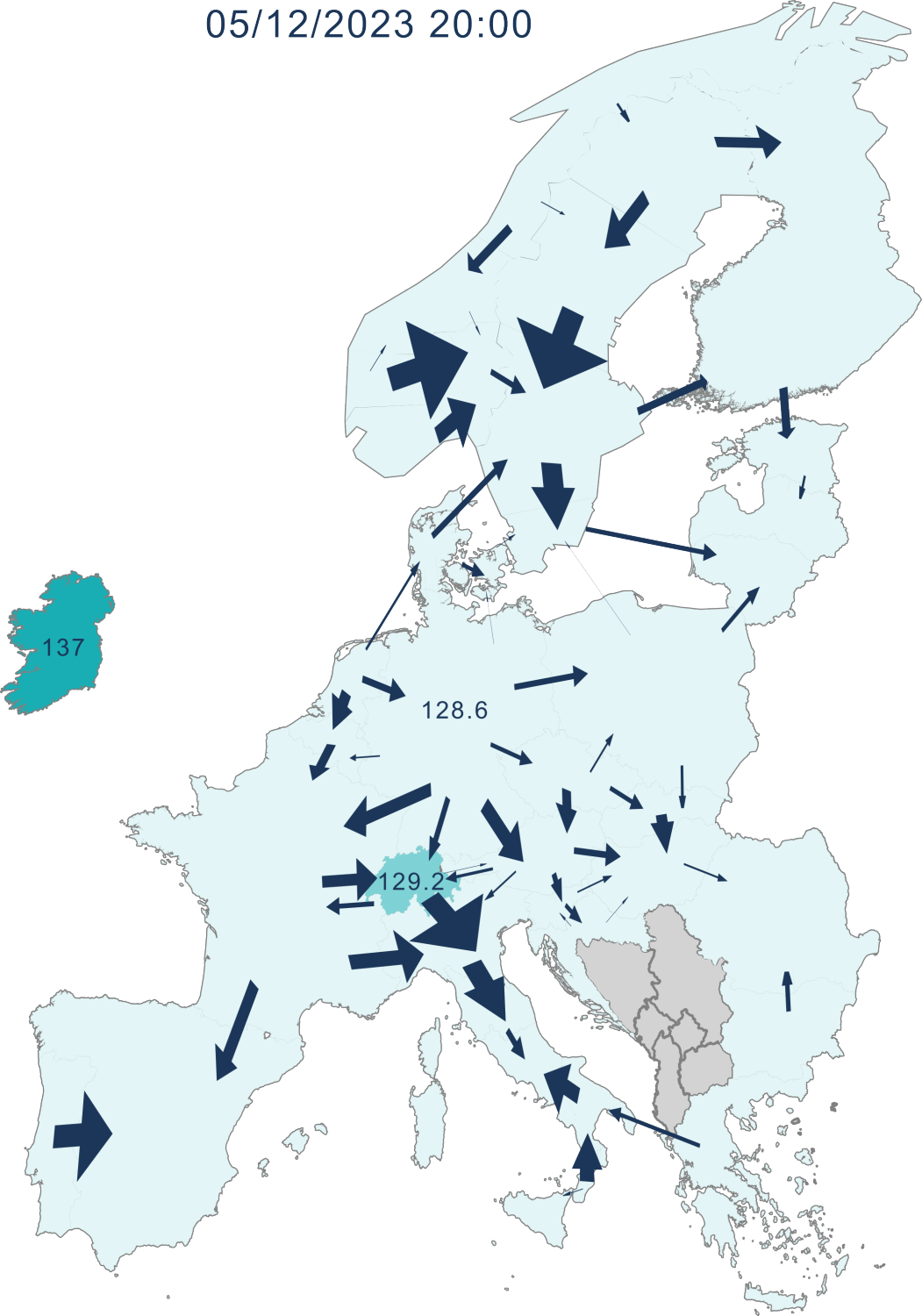

In 2023, this full price-convergence scenario happened in December, when only Ireland (because it is not anymore/yet physically connected to the rest of SDAC) and Switzerland (because of the explicit allocation mentioned in part 1) had a slightly higher price. Every bidding zone border not involving CH had a price spread equal to exactly zero (see figure below)!

On the 5th of December 2023 at 20:00 CET, price spreads were 0 on

Intuitive flows, but congested

Usually, commercial exchanges occur from a low price to a high price area, but the cross-zonal capacity is not sufficient to achieve full price convergence, such that the electricity prices in the two bidding zones differ. This is what we call congestion (market congestion, to be exact). We will see in part 3 that, overall, the “congested” status is the most common one in SDAC.

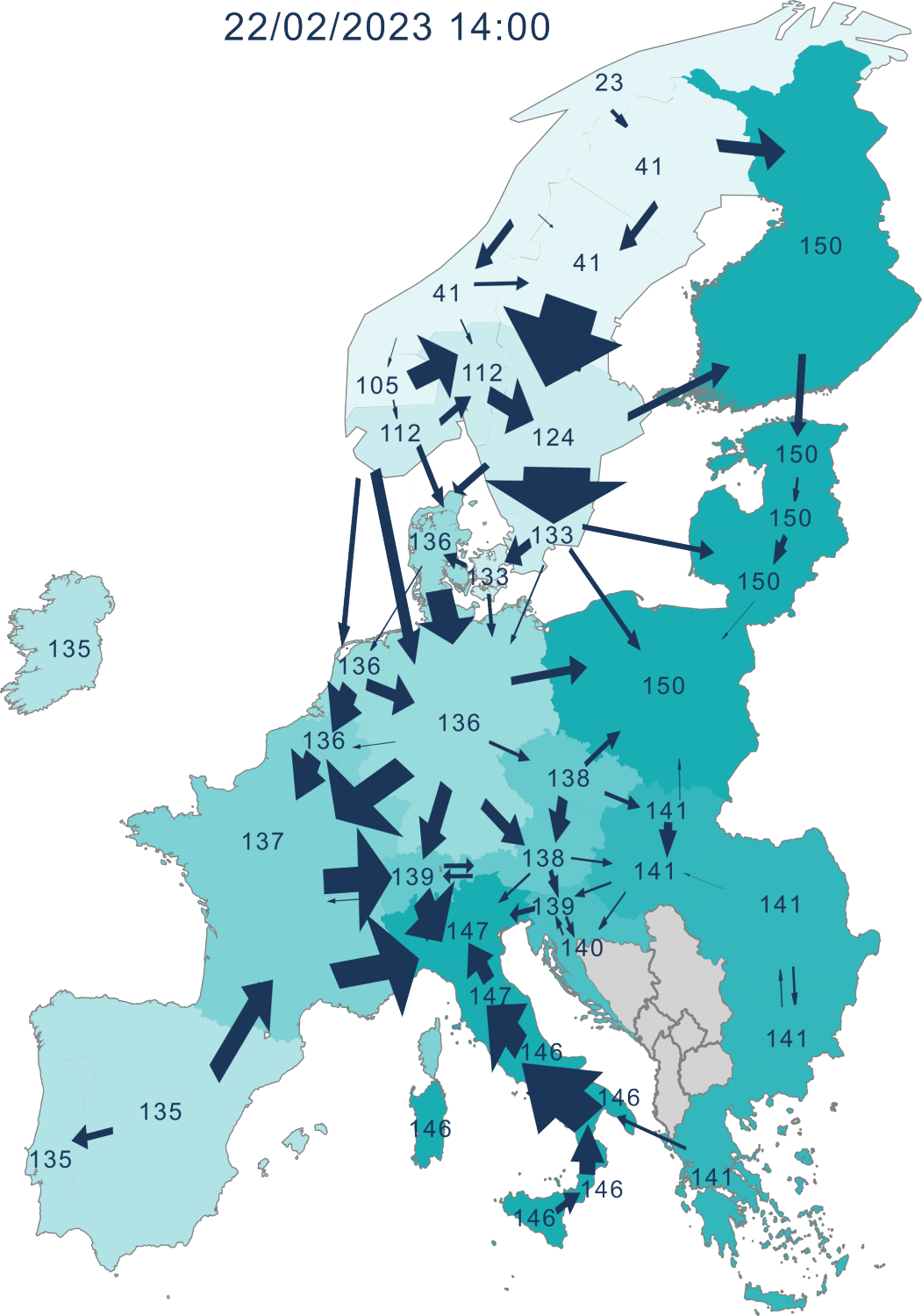

The moment most bidding zone borders were congested at the same time in 2023 was 22/02/2023 at 14:00 CET when 47 borders (out of 67) were congested (see figure below).

On this occasion, the non-congested bidding zone borders were all those of Baltic and SEE CCRs. All bidding zone borders in Italy North CCR and many in Nordic CCRs were congested (these trends will be further analysed in part 3). In Core CCR, many adjacent bidding zones did not reach price convergence, which does not automatically imply congestion since flow-based capacity calculation is applied in Core (extended LTA inclusion is used in Core CCR, such that the market clearing point can be determined by the FB domain and/or the LTA domain). This is a very good reason why having a coordinated (flow-based) process for capacity calculation, which can use the available transmission capacity as effectively as possible, is necessary.

Why?

Coordinated flow-based capacity calculation was introduced in 2015 (in Central Western Europe – FR, BE, NL, DE, AT). Before that, to ensure the operational security of the system, each TSO would have to be conservative about how much transmission capacity to offer bilaterally on each bidding zone border. This would systematically result in considerable unused and unavailable cross-zonal capacity. A coordinated capacity calculation methodology is a great efficiency improvement compared to bilateral agreements between two adjacent TSOs on how much capacity they can make available for cross-zonal trade.

A few steps would ensure even more efficient use of the scarce cross-zonal transmission capacity:

- Using a flow-based capacity calculation process (rather than NTC-based). This has been used in Core CCR since June 2022 (see my previous post about this here) and is expected to be implemented in Nordic CCR in 2024. This is particularly important for regions where the grid is highly meshed.

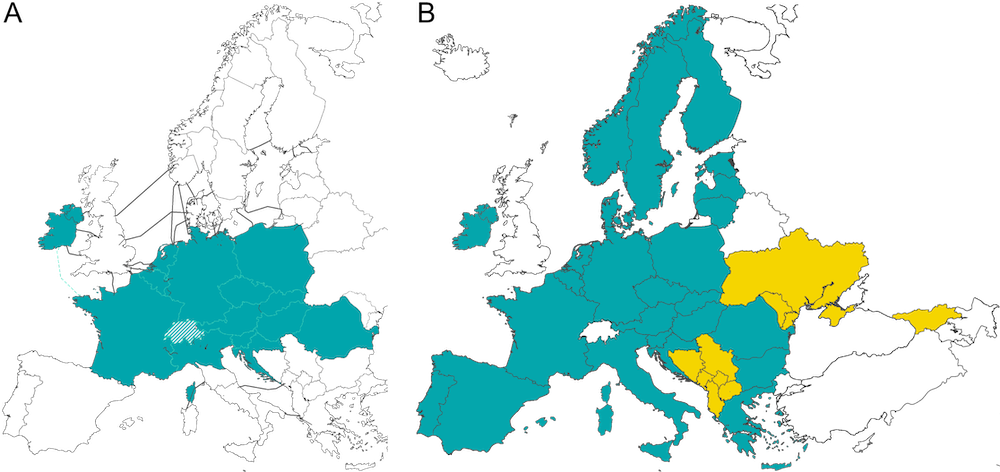

- Enlarging the perimeter of CCRs. One step in this direction is the establishment of a new CCR which constitutes the merger of Core CCR and Italy North CCR. This is currently under discussion (with the working name Central Europe CCR), and is expected to be approved by ACER in March 2024 (see here and here for more information). Likely, Switzerland will also participate operationally in the day-ahead capacity calculation process (but not be part of the CCR, formally). Currently, the expected timeframe for the implementation of this process is 2027. Additionally, the same ACER decision should assign the bidding zone border FR-SEM to Core CCR, valid from when the Celtic Interconnector will physically reconnect Ireland to SDAC (expected end of 2026). Note: SEM is the Single Electricity Market of Ireland. [Addendum: ACER published the decision on establishing the new Central Europe CCR on 19/03/2024, which includes all the bidding zone borders in Core CCR, Italy North CCR, and the SEM-FR bidding zone border.]

- Improving the capacity calculation methodology at the external borders of the CCRs that apply flow-based. One step in this direction is the implementation of Advanced Hybrid Coupling on the external borders of Core CCR, expected for 2025 (link). The Nordic flow-based capacity calculation is planned to go live with Advanced Hybrid Coupling from the start.

- Although not directly involving capacity calculation, increasing the geographic scope of market coupling would also improve the efficient usage of the scarce cross-zonal transmission capacity (and reduce the incidence of counterintuitive flows). There are ongoing efforts to extend SDAC to the Energy Community (link), which includes countries in the West Balkans (Albania, Bosnia and Herzegovina, Kosovo, North Macedonia, Montenegro, Serbia) and Black Sea region (Georgia, Moldova, Ukraine). Including Switzerland and the UK in SDAC would also reduce the occurrence of counterintuitive flows on the respective bidding zone borders, as the inefficiency of explicit auctions would be alleviated.

Geographical scope of A) Central Europe CCR (CH is not part of the CCR, but will cooperate on relevant processes such as day-ahead capacity calculation) and B) SDAC, in yellow the countries part of the Energy Community.

Counterintuitive flows

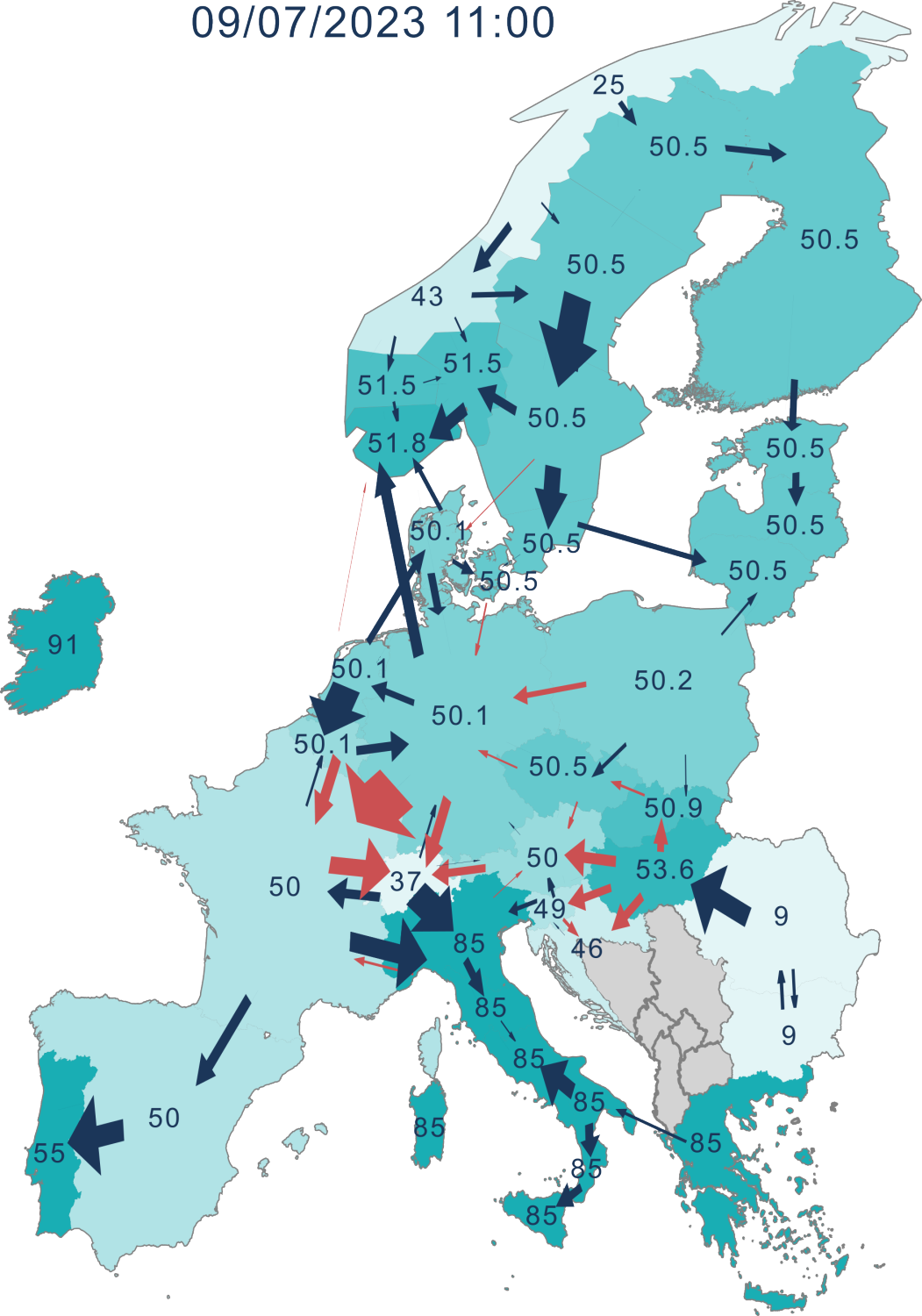

Let us finally look at MTUs with several counterintuitive exchanges, choosing the hour with the most counterintuitive flows of the year, 11:00 CET on 09/07/2023. For that hour, 19 bidding zone borders had counterintuitive (net) commercial exchanges in the day-ahead market.

A few observations:

- Counterintuitive flows don’t affect the radial areas (i.e. where bidding zones are connected “in a row”). Examples of this are SWE, SEE, Baltic, and GRIT CCRs (see the first figure for a reminder of the various CCRs). We will see in part 3 that this situation is quite common.

- CH shows counterintuitive flows because of the explicit allocation described in part 1 (link)

- Hansa, Nordic and Italy North CCR show a few counterintuitive flows, but these are rather small (50-200 MW). These will be explained in detail in part 3. The main reasons are ramping constraints on HVDC interconnectors, and allocation constraints (for a list of constraints see part 1)

- Core CCR shows several counterintuitive flows (i.e. on 11 bidding zone borders out of 19). Why? Hard to say exactly, but two reasons are most likely:

- The price spread on the HU-RO border is so large that it is convenient to import from RO as much as possible, even though this means re-exporting from HU against the price differential. There is an overall welfare gain because the loss (HU exports times the price spread, per border: 1225x3.6 + 887x4.6 + 892x7.6 + 746x2.7 ~ 17'284) is much lower than the gain (exchange from RO to HU times the price spread: 2202x44.6 ~98'209)

- The price difference on the FR-NORD bidding zone border is very large compared to the FR-BE and FR-DE borders. Therefore, it makes sense to have power flow counterintuitively into FR, in order to be able to re-export it to NORD with an overall welfare gain.

Takeaways & outlook

In this second article on counterintuitive flows, I showed examples of intuitive (both congested and uncongested) and counterintuitive commercial exchanges.

I also highlighted a few possible future steps to increase the efficiency of capacity allocation and to reduce the incidence of unwanted counterintuitive flows (remembering that not all counterintuitive flows are unwanted).

In the third part I will (finally!) analyse market data from 2023, identify patterns and show trends by (type of) region.

If you would like to discuss these results further, please comment or get in touch via PM (to me or Reinhard Kaisinger ).

Industry Topics

Market Coupling, Day-Ahead

Services

Regulatory & Energy Analytics, Energy Strategy & Modelling